Fraud Risks Are Rising—Stop It Before It Happens

- Alan Bebchik

- Aug 21, 2025

- 6 min read

How AI-Powered Anomaly Detection in Salesforce Financial Services Cloud Protects Your Customers

Introduction: The Growing Threat of Financial Fraud

Financial fraud is evolving faster than ever. With digital transactions becoming the norm for everything from personal banking to global investments, fraudsters are finding new ways to exploit weaknesses. According to industry reports, financial institutions lose billions of dollars each year to fraud. This not only results in significant financial loss but also causes reputational damage that can have long-term consequences for organizations.

Manual audits or rule-based monitoring are no longer enough. These systems often flag legitimate activity as suspicious and miss cleverly disguised fraudulent transactions. Fraud types such as identity theft, wire fraud, phishing attacks, financial statement fraud, asset misappropriation, and other deceitful practices are becoming more sophisticated. These fraud schemes are constantly evolving, creating emerging threats and increasing potential risks for organizations. Recognizing risk factors is essential to prevent financial loss and protect organizational assets. Understanding the different fraud types and their associated risk factors is crucial for developing effective prevention strategies.

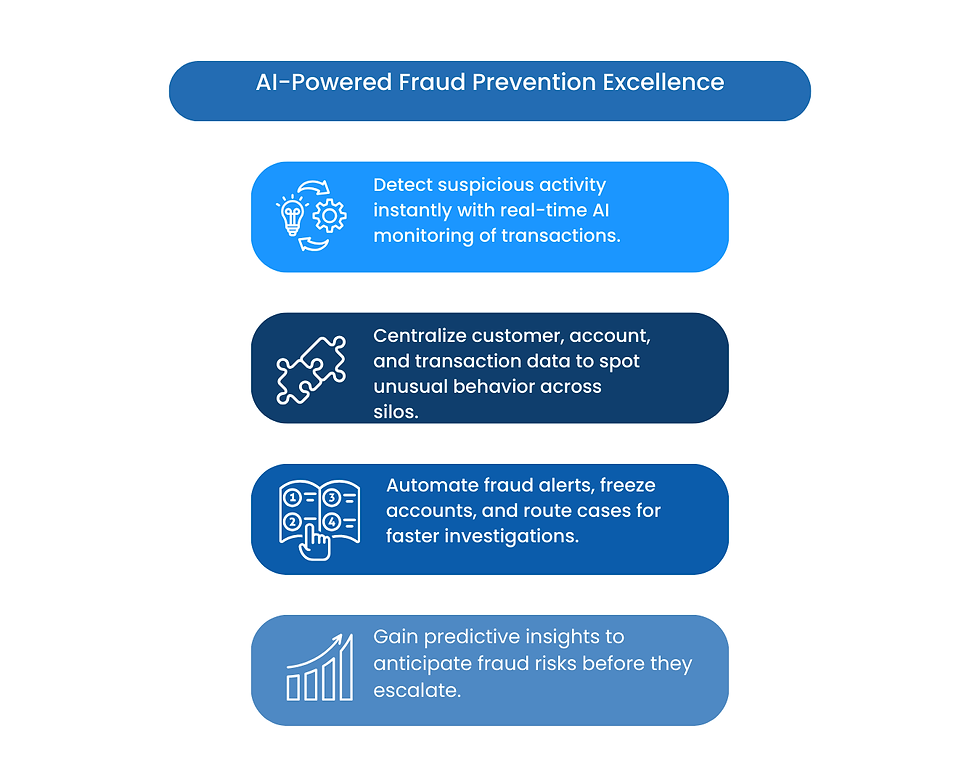

Salesforce Financial Services Cloud (FSC) with AI-powered anomaly detection gives financial institutions a way to get ahead of fraudsters. By identifying unusual behavior in real time, you can protect your customers, preserve trust and comply with strict regulations.

At its core, anomaly detection is the process of identifying data points or behaviors that are out of the ordinary. In financial services this could be:

A sudden transfer of a large amount of money to an unknown account.

Multiple login attempts from different geographies in minutes.

A transaction pattern that doesn’t match a customer’s typical behavior.

AI-powered anomaly detection uses advanced machine learning models trained on historical data to recognize these patterns. These systems are driven by artificial intelligence and artificial intelligence ai, which enable them to analyze vast amounts of data and identify subtle anomalies that traditional methods might miss. Technology plays a crucial role in enhancing the accuracy and speed of fraud detection.

Unlike rigid rules, AI adapts dynamically—learning what “normal” looks like for each customer and each account. Technological innovation and data analytics enable real-time detection and improve fraud detection tools, allowing financial institutions to respond quickly to emerging threats. This allows financial institutions to separate legitimate transactions from suspicious activity with much greater accuracy.

Why Salesforce Financial Services Cloud Is the

Perfect Partner

Salesforce FSC is already a hub for customer relationships, financial portfolios and compliance workflows. By adding AI-powered anomaly detection on top of this, financial institutions get a seamless proactive fraud defense system.

Salesforce FSC also provides a comprehensive defense against fraud by combining preventive and detective controls to protect against evolving threats.

Here’s why this works so well:

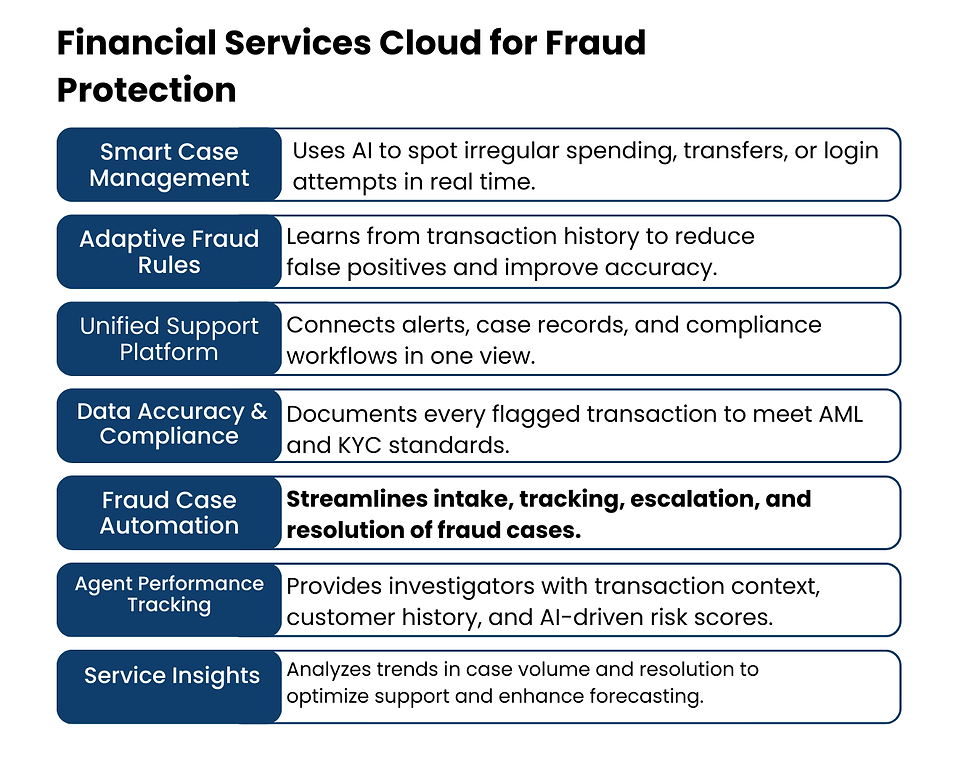

Unified Customer View – FSC consolidates all customer data—transactions, accounts, interactions—into one dashboard. This unified view gives AI models more context to detect anomalies.

Real-Time Monitoring – Integrated AI models scan transactions as they happen, flagging suspicious behavior before it escalates.

Compliance Alignment – With built-in compliance tracking, you can automatically document fraud investigations and prove compliance with regulations.

Scalability – Whether you’re a regional credit union or a multinational bank, Salesforce has the infrastructure to handle millions of transactions securely and efficiently.

Fraud Risk Management Strategies – Implementing effective strategy and robust fraud risk management strategies within Salesforce FSC maximizes protection and ensures your organization is prepared to detect, prevent, and mitigate various types of fraud.

Real-World Examples of AI Catching Fraud

Let’s look at a few scenarios where anomaly detection makes a difference:

Unauthorized Wire Transfers: A customer usually sends monthly payments of $1,500 to a local vendor. Suddenly the account initiates a $50,000 transfer to an overseas address. AI flags the outlier and freezes the transaction for review, helping organizations respond quickly to fraud events and distinguish between suspected and actual fraud.

Account Takeover Attempts: A user logs in from New York, but within 15 minutes another login is attempted from Europe using the same credentials. AI detects the geographical inconsistency and triggers multi-factor authentication.

Credit Card Misuse: A card that’s used for groceries and gas suddenly racks up luxury purchases in a different state. The system identifies the spending deviation and alerts the customer in real time.

Synthetic Identities and Fraudulent Activity: Fraudsters create synthetic identities using stolen personal data or real Social Security numbers to open accounts and commit fraudulent activity. AI-powered solutions can detect these counterfeit personas and flag suspicious behavior before actual fraud occurs.

These interventions not only prevent fraud losses but also build customer trust. Clients see their bank actively protecting them, turning a potential negative into a loyalty-building moment.

Key Benefits for Financial Institutions

1. Stronger Customer Trust

Trust is everything in financial services. Customers want to know their money and data are safe. AI-powered fraud prevention shows the institution is proactive in protecting assets, which translates into higher retention and loyalty.

2. Reduced Operational Costs

Manual fraud reviews are expensive and time-consuming. AI cuts down false positives—cases where legitimate transactions are mistakenly flagged—so teams can focus on real threats.

3. Regulatory Compliance Made Easier

Financial institutions operate under strict frameworks like AML (Anti-Money Laundering) and KYC (Know Your Customer). AI systems built into FSC help institutions meet these standards by documenting flagged transactions and streamlining reporting.

4. Real-Time Protection

The most powerful feature is speed. By catching fraud before money leaves an account, institutions avoid lengthy recovery battles and protect both the bank’s and the customer’s bottom line.

The Human Factor: Employee Training and Awareness in Fraud Prevention

While advanced technologies like AI and machine learning are transforming fraud risk management, the human element remains just as vital. Employees are often the first line of defense against fraud risks, and their ability to recognize and respond to suspicious activities can make all the difference in preventing fraudulent activities before they escalate.

Effective fraud risk management starts with a proactive approach to employee training. By educating employees about the latest fraud threats, common fraud tactics, and the warning signs of potential fraud, organizations can significantly enhance their fraud prevention efforts. Training programs should cover everything from identifying phishing attempts and social engineering schemes to understanding how internal controls work and why reporting suspicious activities is crucial.

Empowering employees with up-to-date knowledge and practical tools not only helps detect fraud but also fosters a culture of vigilance and accountability. When staff members are confident in their ability to spot and report risks, they become active participants in the organization’s risk management strategy.

Implementation: How to Get Started

For organizations considering AI-powered anomaly detection in Salesforce FSC, here are the steps:

Assess Current Fraud ProcessesMap out existing fraud detection workflows. Identify bottlenecks, manual tasks and areas where fraud has slipped through. Conduct a thorough risk assessment and fraud risk assessment to identify potential fraud risks and evaluate specific vulnerabilities within your organization.

Integrate AI Models into FSCUse Einstein AI or partner solutions for Financial Services Cloud. Models can be customized to your institution’s needs.

Train the System with Historical DataFeed past transaction data to the AI to learn what “normal” looks like. This reduces false positives when monitoring live transactions.

Create Automated WorkflowsWhen anomalies are detected, automated workflows can freeze accounts, send alerts or require secondary approvals—reducing response time from hours to seconds.

Monitor, Adjust, ImproveAI models get better over time, but continuous monitoring ensures accuracy. Regular reviews allow you to adjust sensitivity levels and fine-tune detection rules.

To maximize the effectiveness of your fraud prevention strategy, seek actionable insights from your data, implement proactive measures to deter and detect fraud, and consider consulting certified fraud examiners for expert guidance. These steps will help strengthen your defenses and ensure your organization is prepared to address evolving fraud risks.

Looking Ahead: The Future of AI in Fraud Prevention

Fraudsters won’t stop innovating and neither should financial institutions. As AI evolves, anomaly detection will get even more precise, using natural language processing to detect fraudulent communications and blockchain analytics to track hidden transfers.

Additionally, AI will move from reactive monitoring to predictive analysis—predicting fraud before it happens by modeling risk scores for each customer. Imagine being able to warn a customer about suspicious activity before fraud occurs. That future is closer than you think.

To stay ahead of emerging fraud, it is crucial to regularly review and update internal controls, and to collaborate with government agencies that play a key role in combating new fraud threats and enforcing regulations.

Conclusion: Stop Fraud Before It Happens

Fraud risks are rising but financial institutions don’t have to play catch-up. By using AI-powered anomaly detection in Salesforce Financial Services Cloud, banks and credit unions can get ahead.

The benefits are clear: stronger customer trust, lower costs, easier compliance and most importantly—real-time protection.

In a world where every transaction could be a target, prevention isn’t just nice-to-have. It’s necessary. AI stops fraud not after the fact but before it happens.

Comments